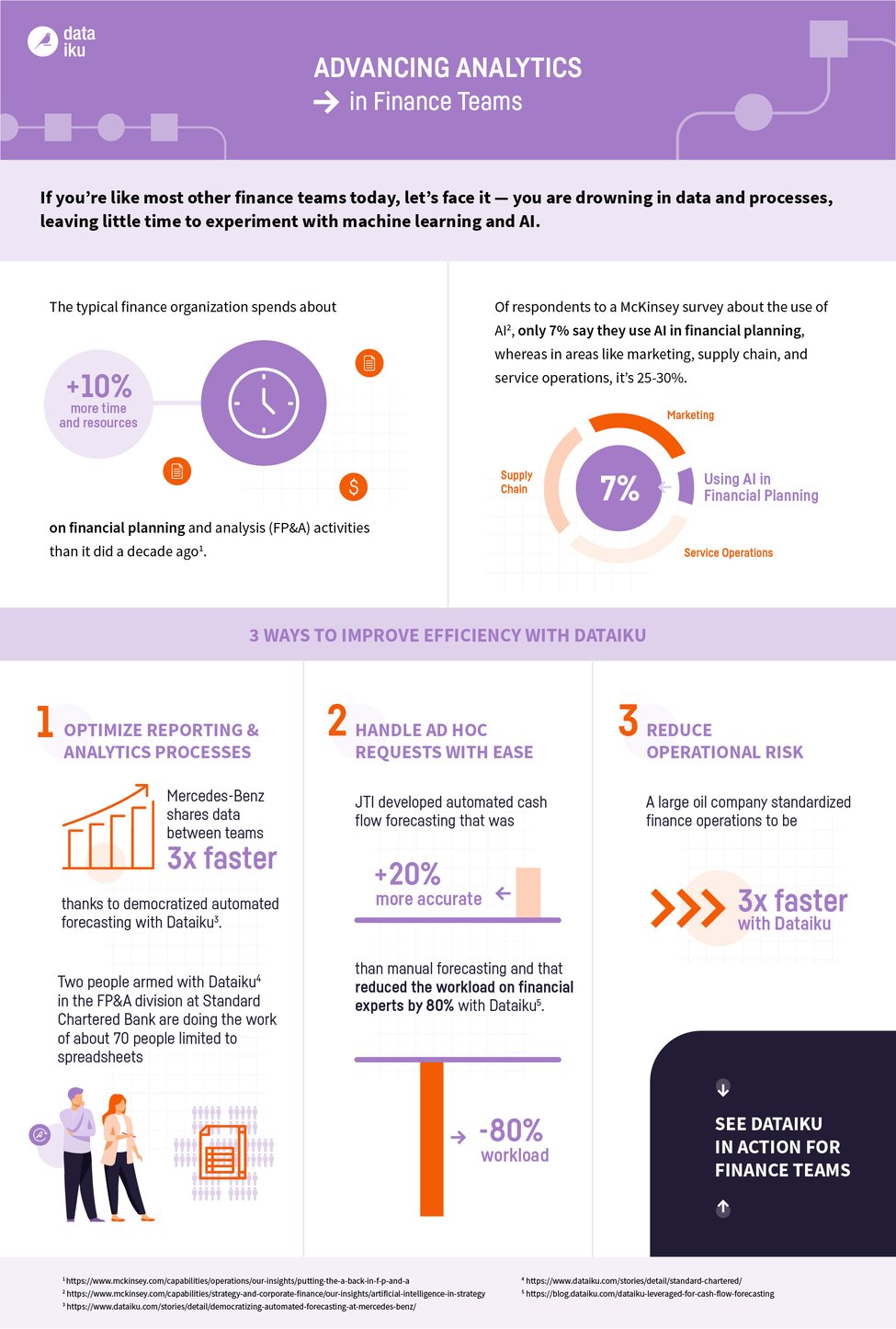

A typical finance organization spends about 10% more time and resources on financial planning and analysis (FP&A) activities than it did a decade ago. With the increase in business data sources that require analysis, often in disparate locations, along with the rise in reporting needs, this is unlikely to be surprising for anyone on an FP&A team. AI and machine learning (ML) have the potential to drastically improve the efficiency of FP&A teams by enhancing financial decision-making processes. However, today only about 7% of companies use AI in financial planning.

Despite the fact that AI is often on the future roadmap in finance transformation initiatives for the Office of Finance, actually going from hypothetical implementation to reality is a challenge for the vast majority of FP&A teams. In this blog post, we'll explore some of the common misconceptions about AI and ways that it can potentially benefit financial planning, forecasting, and analysis.

Common Misconceptions About Using AI in FP&A

Often simply getting started with AI in finance is the most difficult challenge to overcome, partly due to misconceptions many FP&A teams have about AI. Below are some of the most common:

1. AI requires the use of a data scientist or ML expert 100% of the time, and we don't have those resources.

While it’s helpful to have a data scientist, tools like AutoML are available to automatically generate ML models using common algorithms, all in a visual way that doesn’t require coding. This can enable less technical members of FP&A teams, like financial analysts, to quickly upskill themselves to create basic models for tasks like financial forecasts or predictive analytics. And if data experts are involved, they potentially only have to be involved to validate work versus building everything from scratch.

2. AI benefits are only nominal so it's not really worth it for us.

One of the key ways that AI can help FP&A teams is by increasing the accuracy of predictions. For instance, in this story, a company was able to increase forecasting accuracy by 20%, all while decreasing the workload on financial analysts by 80%. Now, with the rise of Generative AI, finance teams have access to many tools to enhance workflows, whether that’s generating email responses, suggesting planning templates, or drafting documentation.

3. AI is too black box for our audit and regulatory-heavy processes.

While it’s true that some types of AI aren’t as explainable as others, many of the types of models used for prediction tasks important to finance teams are much easier to interpret. Additionally, some vendors (like Dataiku) incorporate explainability features in model development including bias detection, individual prediction explanations, and even automatically generated model documentation.

4. AI isn't real yet for finance teams.

While adoption still remains low for most FP&A teams, AI still has real potential now to make processes more efficient, results more accurate, and give a competitive advantage to the companies that adopt it. To give a couple of real-life examples, Mercedes-Benz was able to share data 3x faster between teams, and JTI was able to increase forecasting accuracy 20% as mentioned above.

Areas of Opportunity for AI in FP&A Teams

So what are the key FP&A processes where AI could be introduced? These are some of the primary areas where ML can drastically improve efficiency and accuracy:

Futuristic Forecasting

Accurate forecasting is vital for effective financial planning, and AI can help teams increase this at impressive levels. By leveraging historical data along with external factors like market trends and economic indicators, AI algorithms generate more accurate and reliable forecasts. ML models can even continuously improve their predictions over time as they learn from new data inputs.

AI-powered forecasting tools also allow for scenario analysis, enabling FP&A teams to assess the potential impact of different business decisions on financial outcomes. This helps organizations make informed strategic choices and mitigate risks associated with unpredictable market conditions.

To help FP&A teams get started with AI-powered financial forecasting, Dataiku offers a pre-built template that finance teams can simply customize with their company’s own data.

Uncover Areas for Optimization

When analyzing historical data, AI algorithms can uncover patterns and correlations that might elude human analysts. By gaining a deeper understanding of past trends and outliers, FP&A teams can uncover new trends in customer behavior, market performance, and other factors that have a financial impact.

By identifying these emerging trends and potential opportunities, FP&A teams can proactively develop strategies to optimize financial performance and gain a competitive edge.

Real-Time Insights for Proactive Action

Thanks to AI-powered reporting, FP&A teams can access real-time insights and customizable dashboards to proactively monitor an organization's financial performance.

AI has the potential to automate data consolidation from multiple sources, enabling FP&A teams to quickly generate accurate and up-to-date reports. These reports can be tailored to meet specific stakeholder needs, facilitating informed decision-making across departments. Real-time reporting and dashboards empower FP&A professionals to swiftly identify and address issues, ensuring that financial plans stay on track.

AI Can Feel Intimidating, but Dataiku Makes It Easier to Get Started

Still not convinced AI is the right move for your team today? Dataiku is not just the platform for Everyday AI, it’s a central analytics workbench that empowers your team to grow into your AI objectives while helping you solve your most pressing issues today, from improving data analytics to improving response time to ad-hoc requests to accelerating time-to-compliance.

Check out this infographic to see how Dataiku can help finance teams today: