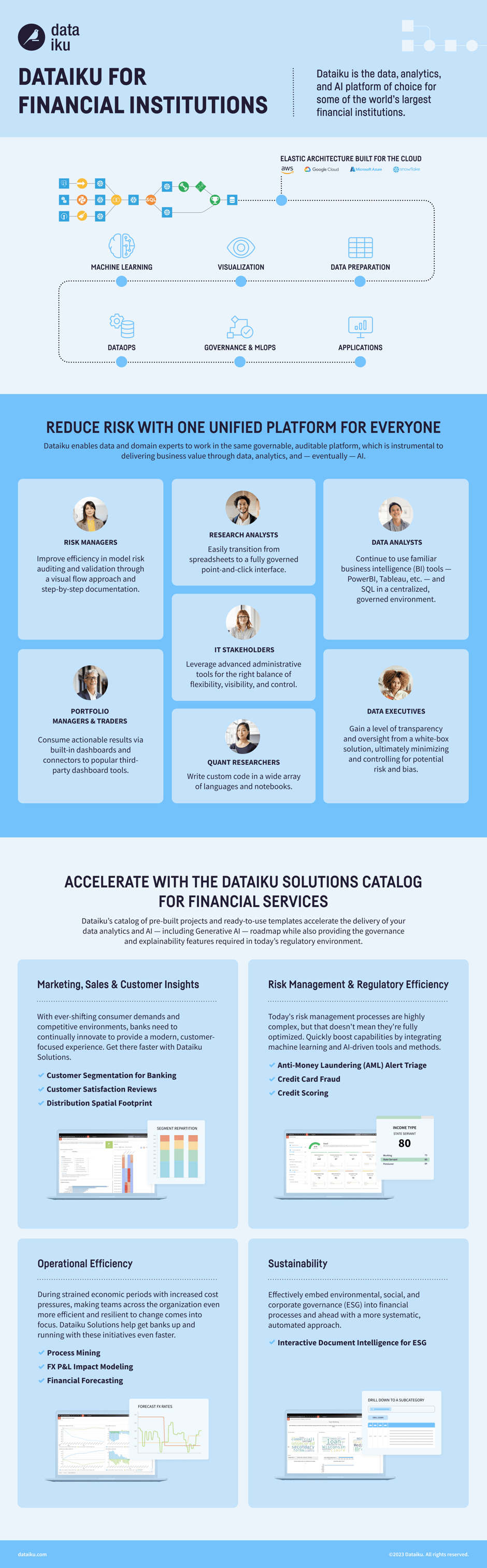

In the financial services industry, there is no shortage of complex problems whose solutions can be arrived at more quickly — and more effectively — with the help of advanced data analytics. From credit card fraud detection and anti-money laundering processes to next best offer models, banks of all stripes are increasingly turning to AI platforms to power their data projects. At Dataiku, we've worked with over 120 financial institutions and data teams big and small to help bring the industry into the data-driven future.

When it comes to choosing the right platform, two essential characteristics need to be held in balance: high power and low risk. Platforms like Dataiku allow users to break away from spreadsheets, build intelligent and potent (often machine learning) models, visualize their data, and build value-adding insights swiftly and without friction. Crucially, they also allow stakeholders across the firm — from data engineers to analysts in the line of business — to work collaboratively on the same projects with clear, governable, and auditable oversight every step of the way, minimizing risk while retaining power.

Whether you work in asset management, fintech, or retail banking, there's more you can be doing to leverage your data. There's no time like the present to join the long list of institutions who are getting ahead on their AI and advanced analytics projects — with a little help from Dataiku!