AI is often called the fourth industrial revolution. The first one was driven by the steam engine, the second by electricity, and the third by semiconductor. We can learn a lot from the first three industrial revolutions about how to create value with AI.

But first, a few highlights of AI/ML’s long history of value creation.

1976: The New England outfitter L.L. Bean developed recency-frequency-monetary-value (RFM) models for seven million customers. Storage alone cost them $2.5 million in today’s dollars, but they quickly became a top U.S. mail order retailer.

1984: Chase Bank direct mail predictive models for credit card customer acquisition showed that the optimal campaign was to mail to everyone. They did.

1991: HNC Falcon, a 500 parameter artificial neural network, detected credit card fraud in real-time and saved banks hundreds of millions of dollars.

2001: Amazon.com product recommendations generated about 25% of company revenue, billions per year.

2012: Facebook reached one billion monthly active users, driven by personalized news feeds that captivated users’ attention.

2017: Google’s AlphaZero chess program played 10 million games against itself in two hours and became better than any human. After four hours, it was the best chess program ever.

2021: A semiconductor manufacturing equipment provider optimized new chip recipes using deep learning and 50,000 input signals, generating $1 billion in value per factory.

2022: OpenAI ChatGPT acquired one million users in five days.

ChatGPT reached a million users in 7% of the time it took Instagram, 2% of what it took Facebook, 0.7% Twitter, and 0.4% Netflix. Today, LLMs are increasing the productivity of the bottom two deciles of call center agents by 35% and of programmers by 60% to 120%. And GPT-4 can answer general questions, like how to stack a book, a laptop, nine eggs, a bottle of soda, and a nail so that they don’t fall over. It feels like a tipping point for AI. Yet most companies fail to generate significant positive ROI with it. Why? Maybe we can learn from the previous three industrial revolutions.

Point Solutions, Applications, and Systems

Thomas Newcomen introduced the first commercial steam engine in 1712, which was primarily used to pump water out of coal mines. Efficiency wasn’t an issue since, for that use case, fuel was literally lying about on the ground everywhere. Sixty-four years later, James Watt modified Newcomen’s design by adding a chamber for cooling steam, increasing efficiency 4x and starting the first industrial revolution.

The first use cases were point solutions, or one-to-one replacements of previous power supplies, like replacing a watermill with a steam engine. But point solutions are usually insufficient to scaling a new technology because change is difficult, so novel applications were developed including railroad locomotives and steamboats that were far more valuable than point solutions. The apps, in turn, enabled whole new systems such as Sears & Roebuck’s catalog business. (You need a railroad to mail-order a house.)

Point solutions were also the first value generators in the second industrial revolution, electricity, when light bulbs replaced candles and oil lamps one-for-one and increased lumens per dollar by 4x. It’s no coincidence that Watt’s engine and light bulbs both had 4x efficiency gains: Big cost savings motivate people to change to a new technology but generally aren’t enough to drive widespread adoption and “cross the chasm”. (Dataiku’s AI platform, by design, also drives 4x efficiency gains.)

New applications like vacuum cleaners and electric motors drive adoption to a tipping point which then leads to new systems and massive value creation like Ford’s moving assembly line. Ford’s manufacturing breakthrough wouldn’t have been possible without electricity. The moving assembly line, with its 7x productivity gain, was much more valuable than any app.

To appreciate how new applications create value by redesigning processes, consider the process of cleaning household carpets:

Before Electricity

- Move furniture off the carpet.

- Roll up the carpet.

- Haul it outside.

- Hang it over a clothesline.

- Get a wicker carpet beater from the closet.

- Beat the carpet.

- Put the beater back in the closet.

- Roll up the carpet.

- Haul it inside.

- Roll it out.

- Put the furniture back in place.

After Electricity

- Get the vacuum cleaner from the closet.

- Plug it in.

- Run it over the carpet.

- Put the vacuum back in the closet.

Semiconductors drove the third industrial revolution in a similar pattern. Handheld transistor radios replaced tabletop radios (and were 4X more efficient on power) and personal computers replaced typewriters. New applications like the Pong video game and VisiCalc spreadsheets launched whole new industries. Some say that VisiCalc and desktop computing were instrumental in launching the junk bond industry because they collapsed the process of financial modeling:

Before VisiCalc

- Specify the calculations you want to run.

- Send it to the computer department.

- Wait your turn (days or weeks).

- Get back a printout of results.

- Find errors. Rewrite specification and send it to the computer department.

- Repeat for weeks or months, or give up.

After VisiCalc

- Turn on your Apple II desktop computer.

- Do your own self-service calculations.

More recently, some of the first use cases for the public internet were 1-to-1 replacements of retail paper catalogs (e-commerce) and newspaper classified ads (Craigslist). Then, novel applications such as Expedia, Match.com, Facebook, and Fortnite were developed. Their adoption led to new systems such as iPhones and Uber that were radically different from the initial point solutions. Many readers may be too young to remember booking travel before the internet:

Before Expedia

- Drive across town to a travel agency.

- Describe what you want.

- View a bunch of brochures.

- Bring a few home to show your family.

- Discuss with your family.

- Drive back across town a few days later.

- Book your flights and hotel.

- Drive home.

- A few days later drive back across town to pick up your tickets and itinerary.

After Expedia

- Sit down at your computer.

- Browse and discuss with family.

- Book flights and hotels.

AI, the fourth industrial revolution, seems to be following the same pattern. FICO scores replaced loan officers and GitHubCopilot is replacing Stack Overflow. Applications like HNC Falcon, Facebook personalized feeds, and Amazon.com product recommendations drive scale. Falcon generated value by eliminating a laborious process:

Before HNC Falcon

- Read your monthly credit card statement.

- Spot a fraudulent transaction.

- Call customer service to report it.

- Their fraud department reviews the claim days later.

- If they agree it’s fraud, then they submit a reimbursement request, else restart at step 3.

- Receive a refund 60 to 90 days later.

After HNC Falcon

- Fraudulent transactions are declined in real time.

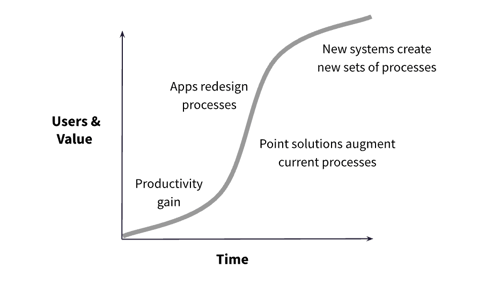

The general sequence across four industrial revolutions seems to be big productivity gain, point solutions, applications, and emergent systems:

Individual Use Cases

The adoption S-curve is mostly about human nature rather than technology. People don’t like change since it tends to be more expensive than expected. Thus, they don’t mess with working processes until they see some gains from a new technology. They don’t change processes until they tune the old ones, and they don’t create new systems of processes until the old ones have been revised a few times. It’s human nature and doesn’t change. It’s so constant that it’s what mathematicians call scale free: It behaves about the same at all scales (sizes) from industrial revolutions to industries to technologies to use cases. That makes it actionable.

Let’s take consumer auto insurance as an example. An example AI point solution could provide claims processors with a prediction (and explanation) of cost. An AI app that changes the process could automatically provide customers with estimates and repair shop recommendations for claims that are easy to estimate, without getting a human claims processor involved. A whole new system that’s emerging now is pay-as-you-go insurance based on your personal driving habits.

A wealth management point solution might provide next best action personalized recommendations to financial advisors, while an app would automatically send some of them directly to clients and cc the advisor. A new AI system in that industry could provide next best action recommendations to your clients, your clients’ clients, and your suppliers’ clients. A large mutual fund provider is experimenting with that to gain market share.

Lastly, a point solution in supply chain management might estimate the arrival time of a shipment. An app could automatically route info about shipments that are expected to be very late to a worker most likely to be able to fix it. Today, many companies have AI systems that hedge the price of commodities that they depend on. Cargill and Lane Processing (acquired by Tyson Foods) made more money some years trading grain than delivering it or feeding it to chickens.

So What?

Most people overestimate what they can accomplish in the short term and underestimate what they can accomplish in the long term. Too many organizations overestimate AI development costs and underestimate change management risk, especially for point solutions that affect a lot of workers. If you plan to develop a point solution then ask yourself, “What are the cost-benefit differences of building an application instead?” If you’re planning an app, then ask, “What’s the ROI benefit of a system?” In many cases, I think you’ll find that you’re ready to move up the value S-curve.

To read more about AI economics, see the books Prediction Machines and Power and Prediction.